Imagine the worst has happened. The banking and financial system is dead as a door nail. Pretty soon your food will run out, and you’ll have no choice but to use your stash of gold and silver coins as money.

But how on earth do you do that?

Relax, relax. There’s nothing to it. Many people throughout the world have, for one reason or another, at varying times, had to learn how to do business with a new form of currency—and you can, too. It doesn’t matter whether you have all U.S. coins or foreign coins; don’t panic.

As a matter of fact, until 1857, dozens of foreign gold and silver coins were legal tender in the United States. In many regions, foreign coins were more common than U.S. coins. Nobody thought anything of trading in piezas de ocho, guineas, reales, shillings, ducatoons, pistoles, or U.S. gold or silver coin. Today, along the border with Canada or Mexico, Americans are used to trading in foreign currencies every day. If they can do it, so can you.

A Word about Prices and Values

A “price” is what a willing buyer pays a willing seller.

Remember that.

If you are using gold and silver, walk away if the price doesn’t please you. Vote with your wallet. Unlike dealing with a government, a free market doesn’t hold a gun to your head to make you trade at some legally mandated price.

Two things have happened in the last 150 years to cheapen the value of gold and silver all out of kilter with historic norms.

First, the total money supply has been inflated by adding (a) government paper money and (b) bank credit money to the stock of gold and silver.

Second, gold and silver have been politically demonetized and thereby devalued. History proves this. In Biblical times, a day’s wage was one denarius, a small silver coin equal roughly to two U.S. silver dimes, or about 15/100 of an ounce of silver. Today, a working man’s wages are roughly $80/day. This amounts to 3.333 ounces of silver. Gold and silver have been cheapened, even allowing for the lower price of everything today.

If the worst happens to the U.S. financial system and the dollar fails, you can expect to see gold and silver values skyrocket as the public turns to them for daily transactions. Therefore, it is in your interest to hold your gold and silver as long as you can, and spend your paper money first. Depending on how bad things get, the paper dollar could sink to zero. That’s not a prediction, merely a possibility.

Some Definitions

Fineness

Fineness equals the purity of a gold or silver item, expressed in percentage terms (99.9% pure), in parts of pure metal per thousand parts (900/1000ths or 90% fine), or, for gold, in karats. The karat system states fineness as a fraction of 24 parts:

- 12 karat is twelve parts pure metal out of 24 parts, or 50% pure.

- 18 karat is 18 parts pure metal out of 24 parts, or 75% pure.

Fine Gold or Silver Content (“Content”)

Content refers to the fineness or purity of the item times its gross weight. The Krugerrand, for example, is 22 karat (91.67% fine gold), has a gross weight of 1.0909 troy ounces, and a fine gold content of 1.0000 troy ounce. Don’t miss this important point! This means that coins like the gold American Eagle and Krugerrand do not give you less than 1oz gold, even though they are not pure. Their gross weight is greater than 1oz, but their gold weight is 1oz pure gold. You don’t pay for the alloy they put in there at the mint to harden the coins.

Spot Price

The spot price equals the price of gold or silver in New York for a 100oz gold bar or five 1,000oz silver bars delivered “on the spot.” This is the benchmark price off which every gold and silver wholesale and retail transaction takes place.

The Math of Gold and Silver

Right now, you think in terms of U.S. paper dollars—your numeraire (see “Terms and Presuppositions”) is the paper dollar. When you see a quart of oil on the gas station shelf priced at five dollars, you mentally make the equation, (One quart of oil / five dollars). In other words, you always make U.S. paper dollars the denominator of your equation.

Today when you buy U.S. 90% silver coin, you will pay about twenty paper dollars for every face value dollar (two halves, four quarters, or ten dimes) in silver coin. Mentally, your equation says, (One face dollar silver / twenty dollars paper). Because you are accustomed to valuing everything in paper dollars, it doesn’t immediately occur to you that you can reverse this equation, and think in terms of silver money instead, but you can look at it either way.

one face dollar silver / twenty dollars paper

is the same as

twenty dollars paper / one dollar silver

or

five dollars paper / one quarter silver

and

two dollars paper / one silver dime

Calculating the value of paper money relative to silver or gold doesn’t differ at all from any other foreign exchange calculation.

one paper dollar / four Deutsche marks

is the same as

four Deutsche marks / one paper dollar

or

one Deutsche mark / one “paper” quarter

These examples are simple because they use numbers we can easily calculate with. It gets tougher when the rate looks like this:

one Canadian dollar / 0.69 U.S. paper dollar

which equals

one U.S. paper dollar / 1.445 Canadian dollars

If you were in Canada looking at prices, you could mentally multiply those prices by 0.70 to get a rough approximation of the U.S. paper dollar cost. If you wanted to convert U.S. prices to Canadian prices, for a rough idea you would multiply the U.S. dollar price by 1.50.

In general terms, currency A divided by currency B = some exchange rate E. In other words:

A/B = E

Going the other way and using currency A as the denominator, you’ll find the exchange rate equals the reciprocal of the first exchange rate:

B/A = 1/E

For example, if four Deutsche marks (DM) buy one U.S. dollar, then:

DM 4 / $1 = 4

Turn it around to state the result in dollars, and the exchange rate is the reciprocal of the first rate:

$1 / DM 4 = $0.25

Never Mind All that! How Do I Figure Prices in Gold and Silver?

Here’s what you’ll need to know to make any conversion:

- Content: The fine gold or silver content of your coin in troy ounces.

- Spot Gold or Silver Price: The current price paid for gold or silver in New York for delivery “on the spot” (the benchmark price).

Example

You need a bicycle to get around. At a flea market, you find someone selling an old bike you want for $1,000 in U.S. paper dollars. (Whoops! They’ve dropped a little, haven’t they?) You haven’t got any U.S. paper dollars, but in your pocket are 15 gold British sovereigns, and in your bag $100 face value U.S. 90% silver coin. How much should you offer for the bike? (Don’t panic, and wipe the “this is a word problem” cold sweat from your brow. Remember, you can avoid the math altogether if you have access to our Silver & Gold Payment Calculator at www.silverandgoldaremoney.com.)

- What’s the spot gold price? That morning on the radio you heard that spot gold was trading at $3,000 an ounce.

- What’s the gold content? Your sovereigns each contain 0.2354 troy ounces of fine gold.

- How many sovereigns should I offer? Always multiply cost times content: $3,000 X 0.2354 = $706.20. That’s what each of your sovereigns is worth in U.S. paper money. How many sovereigns should you offer him for the bike?

$1,000 / $706.20 = 1.41 sovereigns.

Well, you can’t cut a sovereign in two, so you have to make up the difference with silver coin. How much will you need?

If 1 sovereign X $706.2 = $706.20, and you need $1,000 for the bike, then $706.20 for the sovereign leaves you short $293.80 in paper.

- What’s the spot silver price? The radio announcer said today’s spot silver price was $190 an ounce.

- What’s the silver content? Your U.S. 90% silver coin contains 0.715 troy ounce per one dollar face value.

- How much 90% coin should I offer? Remember cost times content: $190 X 0.715 = $135.85 (in paper dollar value) per dollar face value U.S. 90% silver coin. You need to make up $293.80 in paper, so:

$293.80/$135.85 = $2.16 face value in U.S. 90% silver coin.

To buy the bicycle, offer the owner one sovereign and $2.20 face value U.S. 90% silver coin. If he’s smart, he’ll take it, because you’re offering him the full price in gold and silver. In fact, because you’re offering him better money than he is asking for, you ought to trim his price a little and begin by offering just one sovereign. Yes, you’re offering him considerably less than his asking price, but you’re also paying in money that will become more valuable in the near future.

How Much Is He Offering Me?

At the same flea market, a trader is offering to buy your silver money. He’s paying $100 in paper for a face-value dollar in silver (this is two halves, four quarters, or ten dimes). Should you take the offer? Is it a good price?

Remember: cost divided by content.

One dollar face value in U.S. 90% silver coin contains 0.715 troy ounce of fine silver. Divide the price the trader is offering you (cost) by the content of the silver coin (0.715 troy ounce) to determine what price per ounce he is offering.

$100 / 0.715 = $139.86 per ounce in paper

You heard on the radio this morning that spot silver was $190.00 an ounce, so the trader is swindling you.

Does It Pass the Stupid Test?

When you are calculating in a hurry, it’s easy to make stupid mistakes. Before you make an offer, put it to the stupid test. Does it make sense? You know that dollars of paper are worth less than dollars of U.S. silver coin. You didn’t reverse the exchange rate, did you? You’re not offering him more dollars of silver than the dollars of paper he asked for, are you? Round and make a rough calculation and check that against what you’re about to offer. Don’t let your pride trip you up. Carry a pad and pencil and work it out long-hand if you’re not sure of what you’re doing. And always, always double-check your math.

Markets transmit price information very efficiently. In the midst of the 1980 gold and silver spike, we saw that efficiency at work. One day, people didn’t know any more about a “pennyweight” than a hog knows about a side-saddle, but the next day, they not only knew what it was, but also what every dealer in town was paying for 14 karat and 10 karat gold per pennyweight.

Selling Scrap Gold or Silver

In Genesis 23:16, Abraham buys a piece of ground to bury Sarah. Concluding the deal, he weighs out 400 shekels of silver, “according to the shekel of the merchant.”

What happens in any gold and silver transaction? You are exchanging a certain weight of metal for a certain amount of some commodity. Coinage offered a superb technological advancement in the use of money. Before coinage, traders had to try every lump of silver and gold to determine its fineness, then weigh each piece to determine its weight. Coinage eliminated that bother by offering a guaranteed fineness and weight of silver or gold.

When you think about it, so does a 14-karat wedding ring or a sterling silver spoon! Don’t laugh—some day, knowing how to figure out the gold or silver content of jewelry or sterling ware might save your life, so here are some simple lessons to determine what gold or silver items are worth.

Silver Standards: How Fine Is Fine?

The critical question about any gold or silver object is, “How pure is it?” Purity varies widely, according to use, custom, and even legal mandates.

Let’s start with silver. Purity or “fineness” is often expressed as a system of 1000 parts, or three or four numbers preceded by a decimal. Thus, sterling silver (92.5% pure silver) may be expressed as .925, 925/1000, 92.5, 92-1/2%, or simply “Sterling.” Silver that is “800 fine” is 80% pure. In most countries, these stamps or hallmarks are defined and regulated by law.

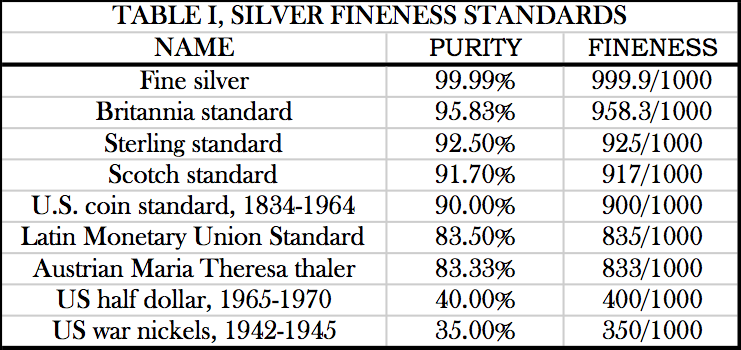

Theoretically, the purest silver—fine silver—would be 100%. However, as a practical matter, even electrolytically refined silver is only 99.99% fine (.9999 or “four nines fine”). Because pure silver is very soft and wears rapidly under use, various alloys are used for silverware, hollow ware, and coinage (see Table 1).

Silver Content of One Dollar Face Value in Coin

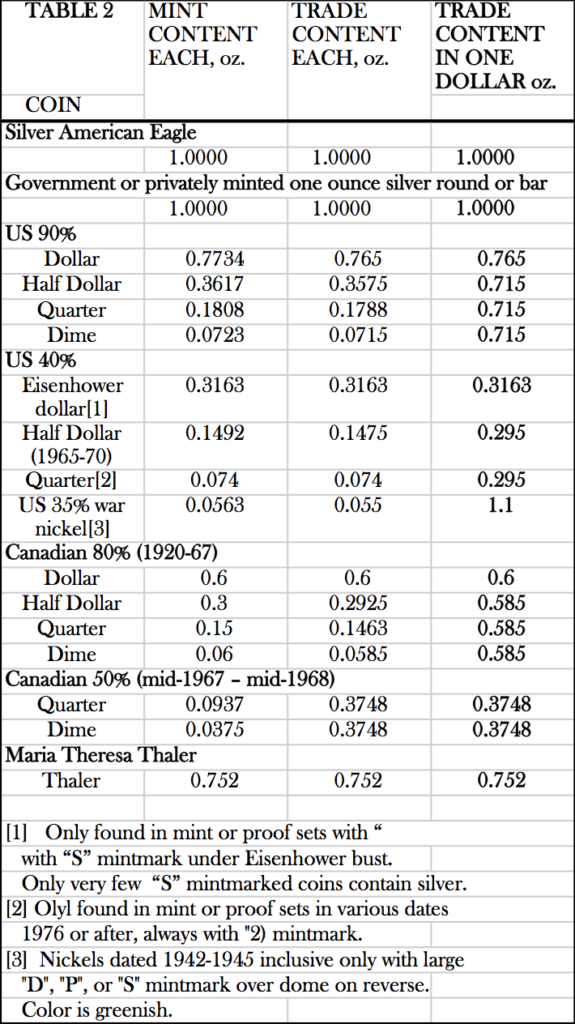

Over time, silver coins wear and lose a little silver content. To allow for circulation wear, the trade reduces the silver content. This is illustrated in Table 2, where original mint values are given in one column, and trade values in the second two columns. For some coins, the mint and trade content are the same because as a practical matter, they never circulated.

Other Foreign Silver Coin Standards

Australia

Australia maintained the sterling standard until 1946, when it reduced the silver content of its coin to 50%. With a few exceptions, silver disappeared entirely from Australian coinage after 1963.

Canada

Until 1920, Canadian coins were sterling silver.

France

France minted 83.5% silver coins before 1915 in denominations from 50 centimes to 5 francs.

Germany

Germany minted 90% silver 50 pfennig, half mark, 1 mark, 2 mark, and 5-mark coins until 1916. After World War II, some (but not all) 5-mark coins are 62.5% silver.

Great Britain

Britain minted pennies (tiny silver ones, not the huge coppers), 1-1/2 pence, 3 pence, 4 pence, 6 pence, shillings (12 pence), florins (24 pence), half crowns (30 pence), and crowns (60 pence) in sterling silver (92.5% pure silver) until 1920, and in 50% silver from 1920 through 1946.

Latin America

Latin American silver coins often reveal their silver content on their face. Look for legends such as “25-gram(os) ley .900” or “ley 0.900 gr. 12.5.” The first indicates “25 grams of silver 900/1000ths fine by law”; the second, “12.5 grams of silver 900/1000ths fine by law.”

Mexico

From 1863, the silver standard for Mexican Republican coinage was 90.3%. In 1905, the standard for most coins of the United States of Mexico became 80% silver, which was further reduced to 72% in 1925, and, with a few exceptions, abandoned altogether by 1945. From 1947–1949, peso coins were issued in 50% silver, then reduced to 30% in 1950, and to 10% from 1957–1967.

New Zealand

Until 1933, New Zealanders used British and Australian coinage. In 1933, the first New Zealand shillings were struck in 50% silver, but this standard was abandoned in 1947.

Misleading Silver Hallmarks

In the United States, silver-containing items are legally required to bear the mark “sterling” or some variation of 925/1000. Items of coin silver (90% pure) must be marked “Coin silver,” “coin,” or 900/1000. Beware the following hallmarks, which are misleading and do NOT indicate any silver content whatsoever:

- Alaska Silver

- Brazil Silver

- German Silver

- Guaranteed 12 DWT

- Mexican Silver

- Nickel Silver

- Peru Silver

- Silverine

- Silverode

- Silveroid

- Silverore

Note well, however, that many fine sterling silver pieces are hand crafted in Germany, Mexico, and Peru. However, these will bear some variation of the “925” mark in addition to the name of the country. The marks “International Silver” or “Rodgers Bros. Silver” must be accompanied by the “sterling” mark, or they are not sterling.

Weighing Silver

The avoirdupois system is the weight system used in the United States (that is, the ounces used on your bathroom scale). Avoirdupois ounces weigh 28.349 grams. However, precious metals—silver and gold—are weighed in heavier troy ounces weighing 31.1034 grams. Table 3 shows the conversion from troy to avoirdupois. Be careful: grains are abbreviated “gr.”; grams are abbreviated “g.”

Converting Avoirdupois and Troy Weight

Avoirdupois Ounces to Troy Ounces

437.5 grains = 1 avoirdupois ounce = 0.911 troy ounce

- To convert avoirdupois ounces to troy ounces, multiply avoirdupois ounces by 0.911.

- Rule of thumb: For a quick approximation, multiply avoirdupois ounces by 0.9 to get troy ounces.

Troy Ounces to Avoirdupois Ounces

480 grains = 1 troy ounce = 1.097 avoirdupois ounces

- To convert troy ounces to avoirdupois ounces, multiply troy ounces by 1.097.

- Rule of thumb: For a quick estimate, multiply troy ounces by 1.1 to get avoirdupois ounces.

Avoirdupois Pounds to Troy Ounces

16 avoirdupois ounces = 1 avoirdupois pound = 14.583 troy ounces

- To convert avoirdupois pounds to troy ounces, multiply avoirdupois pounds by 14.583.

- Rule of thumb: For a quick approximation, multiply avoirdupois pounds by 14.5 to get troy ounces.

Troy Ounces to Avoirdupois Pounds

1 troy ounce = 0.06857 avoirdupois pound

- To convert troy ounces to avoirdupois pounds, multiply troy ounces by 0.06857, or divide troy ounces by 14.583.

- Sorry, there’s no quick way to work this one out!

Converting Troy Weight to Metric Weight

Grams to Troy Ounces

1 troy ounce = 31.1034 grams

- To convert grams to troy ounces, divide grams by 31.1034.

- To convert troy ounces to grams, multiply troy ounces by 31.1034.

Troy Ounces to Kilograms

32.1508 troy ounces = 1,000 grams = 1 kilogram

- To convert troy ounces to kilograms, divide troy ounces by 32.1508.

- To convert kilograms to troy ounces, multiply kilograms by 32.1508.

Metric Tons (“Tonnes”) to Troy Ounces

1,000 kilograms = 1 metric ton = 32,150.8 troy ounces

- To convert metric tons (often spelled “tonnes”) to troy ounces, multiply metric tons by 32,150.8.

- To convert troy ounces to metric tons, divide troy ounces by 32,150.8.

- Note: Precious metals are always weighed in metric, never English, tons.

Quick Conversion Table

- Avoirdupois ounces to troy ounces: multiply avoirdupois ounces by 0.911

- Avoirdupois pounds to troy ounces: multiply avoirdupois pounds by 14.583

- Grains to grams: divide grains by 15.4324

- Grams to grains: multiply grams by 15.4324

- Grams to troy ounces: divide grams by 31.1034

- Kilograms to troy ounces: multiply kilograms by 32.1508

- Metric tons to troy ounces: multiply metric tons by 32,150.8

- Troy ounces to avoirdupois ounces: multiply troy ounces by 1.097

- Troy ounces to avoirdupois pounds: multiply troy ounces by .06857

- Troy ounces to grams: multiply troy ounces by 31.1034

- Troy ounces to kilograms: divide troy ounces by 32.1508

- Troy ounces to metric tons: divide troy ounces by 32,150.8

How to Figure the Market Value of Your Silver Scrap

To calculate how much silver an item contains, use the formula:

Weight in troy ounces X fineness =

fine silver content in troy ounces

Express fineness as decimal fraction, for example, 92-1/2% silver is 0.925.

How to Convert

WEIGH your silver item. If you have no small scales yourself, ask your jeweler or butcher to weigh it.

CONVERT the weight to troy ounces.

- Avoirdupois ounces X 0.911 = troy ounces

- Avoirdupois pounds X 14.583 = troy ounces

CALCULATE the net silver content. First, determine the fineness of your silver item. It will probably be sterling (92.5% pure silver), but it may be coin silver (90% pure), or 800 fine (80%), or even 750 (75% pure). Then, multiply the gross weight in troy ounces by the percentage purity (fineness).

Weight in troy ounces X fineness =

silver content in troy ounces

To calculate the melt or market value of your silver item, you must use the formula:

Silver content in troy ounces X spot metal price =

market value

Example

WEIGH: You have a sterling silver goblet. You take it to the grocery store and ask the butcher to weigh it for you. He thinks you’re crazy, but smiles and puts it on the scale. “0.48 pound,” he says.

CONVERT : The butcher’s scale uses avoirdupois pounds, so you multiply his avoirdupois pounds by 14.583 to get the weight to troy ounces:

0.48 avoirdupois pound X 14.583 = 7.00 troy ounces

DETERMINE FINENESS: To find the net silver content in troy ounces, you have to know the fineness of the silver goblet. When you look on the bottom, you see the word “sterling” stamped there, so you know the goblet is 92.5% pure silver. Now, you multiply again, expressing the fineness as a decimal:

7.00 troy ounces X 0.925 fineness =

6.475 troy ounce fine silver

CALCULATE: To calculate melt or market value, you must multiply the number of fine troy ounces by the market or spot price. For the current market price, look in your newspaper on the page with commodity quotations, or call your local stockbroker or silver dealer and ask him for the “spot price of silver.” He tells you spot silver is $190 an ounce. Now you’re ready to multiply:

6.475 troy ounces fine silver X $190 spot silver price =

$1,230.25 melt or market value

Be warned—if you are selling to a refiner or retailer, they will always pay less than melt value to account for their costs and commission.

Another warning: Many sterling silver items are not solid sterling silver. Knife handles are usually sterling silver foil wrapped around a resin core. Knife blades are stainless steel. Cups, bowls, salt and pepper shakers, and similar items often have a resin-filled base.

How to Figure the Market Value of Silver Coins

WARNING: Many sterling silver items are not solid sterling silver. Knife handles are usually sterling silver foil wrapped around a resin core. Knife blades are stainless steel. Cups, bowls, pepper & salt shakers, and similar items often have a resin-filled base.

The process for calculating the market value of silver coins is identical to finding the melt value of silver scrap, except that fineness is different. U.S. silver dimes, quarters, and halves minted before 1965 and U.S. dollars minted before 1936 are 90% silver by weight. We can take a shortcut here because we already know the silver content of coin in troy ounces. We use the trade weights rather than the mint weights to allow for wear (see Table 2).

U.S. 90% Silver Coin

You have $250.00 face value U.S. silver dimes, quarters, and halves. First, calculate how much silver that represents:

$250.00 X 0.715 oz. per dollar face value = 178.75 troy ounces silver

Now, what’s the spot price of silver? For this example, $20 an ounce. Calculate the melt value:

178.75 troy ounces X $20 per troy ounce spot price = $3,575.00 melt value

U.S. 40% Silver Halves

You have $400.00 in U.S. 40% half dollars minted between 1965 and 1970. First, calculate how much silver that represents:

$400.00 X 0.295 troy ounces per dollar face value =

118.00 troy ounces fine silver

If the spot price of silver is $20, multiply the number of ounces times the spot price:

118.00 troy ounces X $20 per troy ounce spot price =

$2,360.00 melt value

Canadian 80% Silver Coin

You have $525.00 in Canadian 80% silver coin. First, calculate the silver content:

$525.00 X 0.585 troy ounces per dollar face value =

307.125 troy ounces fine silver

Silver’s spot price is $20, so multiply the number of ounces times the spot price:

307.125 troy ounces fine silver X $20 spot price = $6,142.50 melt value

How to Figure the Melt Value of Gold Scrap

You calculate the market value of gold scrap (such as gold teeth, rings, or jewelry) exactly as you calculate silver’s value, but the weights are a bit different. Instead of ounces, you will deal with pennyweights or grams.

Weigh your 14-karat ring. Suppose it weighs one tenth of a troy ounce (0.1097 avoirdupois ounce). Since there are twenty pennyweights in a troy ounce, one tenth ounce equals two pennyweights. More often nowadays, scrap dealers quote the price in grams. Two pennyweights (or 1/10 troy ounce) equals 3.11 grams (see Table 3 in this chapter).

Most dealers quote their prices in “dollars per gram of such-and-such a karat.” If you have a 14-karat ring weighing two pennyweights, and the dealer is paying $7.58 a pennyweight, your ring will fetch $15.16. The same $7.58 a pennyweight for 14 karat equals $4.87 a gram. Expressing your two pennyweights as grams, then 3.11 grams X $4.87 = $15.15.

By the way, $7.58 a pennyweight equals 20 X $7.58 or $151.60 an ounce. Since 14-karat gold is only 58.33% pure, we divide $151.60 by 0.5833 to calculate what price we are getting per pure ounce: $259.90. At $400-an-ounce gold, this would be about a 35% discount—about what you can expect to realize for scrap gold.

Dental gold is always unmarked, and dealers are reluctant to buy it. However, they can usually test it, and most dental gold is 16 karat or better. Beware: there is no such thing as white dental gold.

The color of gold tells you nothing about its purity, only about its alloy. When alloyed only with copper, for example, gold turns a beautiful rose color, like the Krugerrand. The very bright yellow of pure gold looks almost phony.

How to Calculate the Melt or Market Value of Gold Coins

Calculate the melt value of gold coins exactly as you figure the melt value for silver coins, by multiplying the fine gold content by the spot price of gold.

Fine gold content is the net weight of gold the coin contains. To figure fine gold content, multiply the coin’s gross weight by its fineness (purity)—or you can cheat and read the fine gold content off the charts in Appendix 1 (“Common Gold & Silver Coins”) in this report.

To calculate the premium on a gold coin, divide cost by content. Then divide the result by the spot price of gold and convert to percentage. Here’s the long way:

If spot gold is at $400 and your Austrian 100 corona costs $400 but has a fine gold content of only 0.9802 troy ounce, you are actually paying $400/0.9802 = $408.08 per troy ounce.

$408.08/400 = 1.0202

The laborious way to calculate the premium is to multiply by 100 to convert to percentage (100 X 1.0202 = 102.02%), then subtract 100 (102.02% – 100% = 2.02%).

You can forget all that tedious work, however, and look like a genius to your relatives if you’ll just divide the coin’s price per ounce by the spot gold price, knock off the 1 and move the decimal point over two places:

$408.08/400 = 1.0202

or (knocking off the 1 and sliding the decimal point two places to the right)

1.0202 = 2.02% premium

Continue to Part VII: Where’s a Depository You Can Trust?