“This is the end of Western civilization.”

~ Lewis Douglas (U.S. Budget Director), remark to James P. Warburg after

President Roosevelt announced that the U.S. was going off the gold standard, April 18, 1933

Lewis Douglas was wrong, of course. The end of Western civilization had already come 60 years earlier, when the United States demonetized silver.

About 20 years ago, I was forced to recognize a huge gap in my understanding. I know that I am not alone, since over and over I read phrases like, “Gold is the money that has withstood the test of time” and “Gold has always been the only money” and “Gold is the only money with intrinsic value.”

Gold Alone Is Not Enough

This, of course, is all wrong. One hundred percent wrong. The gold standard by itself is a problem, because it is essentially monistic. A gold standard alone is just a fiat standard in disguise. Once gold has been defined as a certain number of units—dollars, marks, lira—then gold is no longer the standard, but rather the fiat monetary unit. It’s only a matter of time until gold is squeezed out of the system completely. A gold standard is just fiat money defined in terms of gold and gold defined in terms of fiat, without any independent valuation to keep the system honest.

A Stable, Self-Correcting System

Bimetallism is the only answer, with gold defined in terms of silver and silver in terms of gold. That offers a self-correcting mechanism to keep the currencies honest. It’s not necessary to add that the free market must define the ratio, and not governments.

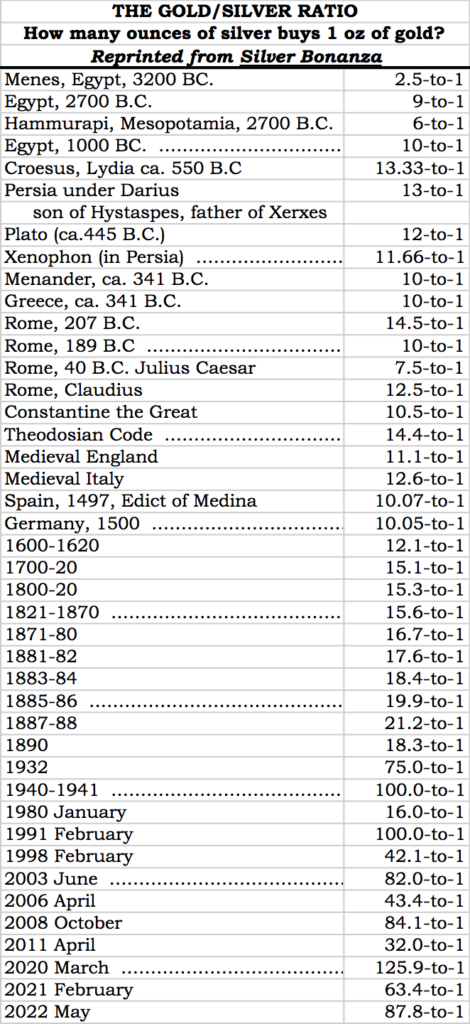

That the bimetallic system is self-correcting can be induced from the 45 centuries men used it. Since what date have we had the greatest monetary and financial instability? Since the introduction of the monometallic gold standard in the 19th century (not to mention the introduction of central banks, beginning with the Bank of Sweden in the 1650s).

I am embarrassed to admit it, but this never quite lodged in my mind until I read an article by one J.N. Tlaga that appeared on LeMetropoleCafe.com (an “Internet café for gold and silver investors”), titled “Gold Standard = Fiat in Disguise.” Why I never saw the real issue in bimetallism, namely, that it keeps the whole system honest and makes fiat money impossible, I can’t explain, but it is a considerably embarrassing oversight. If nothing else, I should have seen it from a philosophical or theological standpoint, because a gold standard system is monist but the universal matrix of truth is Trinitarian, not monist. Anyway, I was blind, but now I see.

The gold/silver system governed itself for nearly 30 centuries, without any governments fixing ratios—markets always did that. The first reference I remember to fixing ratios was the Spanish mint upping the ratio in about 1496, so that argues that they had been regulating it since the Middle Ages. The Romans also issued coins at fixed ratios but deferring to the existing market—not trying to maintain some arbitrary ratio in the teeth of it. Meanwhile, the ancient East operated on a far different ratio, and the world was neither destroyed nor disrupted.

Today, the market’s operation on the bimetallic ratio ought to be far more efficient than ever before, in view of technological advances in communications.

Money Is Too Important to Leave with Government

Once again, we see that the issue of money is far too delicate and crucial to mankind’s health to be left to government. Frankly, I believe the American Founding Fathers thought exactly that way, considering the monetary system they set up.

That system was actually trimetallic, with copper, silver, and gold. The ratio was 840.21 ounces of copper equals 15 ounces of silver equals one ounce of gold, and that’s what the coins gave. They intentionally set up a system with a lower gold-silver ratio than the prevailing world rate (15:1 when the French mint rate was 15.5:1) in order to draw silver—the money of daily commerce—into the country. That seemed correct to them at the time, since the colonies had suffered from a dearth of specie for two centuries.

Dr. Edwin Vieira calls the system the Founders set up “symmetallism.” Whatever the precise term may be, he means a system where one metal is the standard coin (in our case, the dollar of silver per the Coinage Act of 1792) and the coins of the other metal (gold “Eagles,” not even denominated in “dollars” per the same Act, but “valued in” dollars) are periodically adjusted to answer changes in the market ratio. That exactly was done in 1834, without cheating anyone.

And through all this, everyone was free to contract for payment in silver or gold or anything else, without government force or duress. And they couldn’t be forced to take inflated bank notes. And there was no central bank. And from a wilderness Americans built the world’s greatest economy.

But didn’t the fluctuations in value of gold versus silver wreak havoc with world commerce? Against an official U.S. dollar price of $1.292929 an ounce, from 1833 through 1873—four decades—silver valued in gold in London ranged from $1.297 an ounce to $1.36 an ounce (1859). That’s a gigantic, colossal deviation of—4.86 percent! Today, a 4.86% fluctuation in fiat money exchange rates in one day would put everybody to sleep, let alone remaining that quiet for four decades.

The cure for our monetary woes is not a gold standard, but a return to a sound, free-market, self-correcting bimetallic gold and silver standard.

Silver, the Money of Daily Commerce

According to Nobel Laureate in Economics Milton Friedman, “The major monetary metal in history is silver, not gold.”19 Witnessing silver’s importance, man’s languages derive their word for “money” from silver or some silver coin. The Latin denarius silver coin,the Italian danaro, Spanish dinero, and Arabic dirhem or dinar; argentum becomesthe French argent andthe silver coin monnaie becomes money in English. In both ancient and modern Hebrew, keseph means both “silver” and “money.”

For most of mankind’s history, silver and not gold has been the money of daily commerce. Why? Because it takes so many ounces of silver to equal one ounce of gold. Today, a one-ounce gold coin costs about $2,000. How many times did you ever go shopping with a $2,000 bill? Never, most likely. An ounce of silver costs about $25. So, for most of mankind’s history, silver has been the money of daily commerce, and gold the money of very large transactions and international trade.

Silver as Money Today

Today, people are concerned that the U.S. dollar is so mismanaged that it might even collapse, and others are concerned that the global leadership intends to “retire” the U.S. dollar as reserve currency in favor of CBDCs capable of steering or turning off a person’s ability to transact. People are preparing themselves to use silver as money to buy the necessities of life. For that purpose, your silver needs to be divisible and readily recognized. The best choice is U.S. 90% silver dimes, quarters, or halves minted before 1965. However, about the time Biden was inaugurated, a buying panic kicked off in gold and silver.

Because the door into the retail gold and silver market is so narrow, when everybody wants to buy at the same time, they can’t all fit through the door. Premiums surge, deliveries are delayed, and some items simply disappear. The buying panic raises premiums on silver much more than gold. The panic took the premium on 90% silver coin higher than I have ever seen it in 42 years, as high as $7.25 an ounce over spot, which raises the retail premium above 30%. The next cheapest option is the privately minted one-ounce .999 fine silver round, a one-ounce coin of pure silver. If you’re thinking about using silver as money, buy some of both.

The smallest piece of precious metal available is the U.S. 90% silver dime minted before 1965 with 0.0715 ounce of silver worth about $2.10. Fourteen dimes contain nearly one ounce of silver. When you’re trying to buy eggs, milk, and meat, a few of those silver dimes will come in a lot handier than a one-ounce gold coin worth $2000. Using that, if you wanted to buy a dozen eggs, you’d have to take your change in hen houses. Even at today’s high premium, try to buy some 90% silver dimes along with silver rounds, just for the ability to make change. You can put 14 dimes together to make an ounce, but you can’t cut a one-ounce round into fourteen pieces.

In sum, both silver and gold must work together. Valuing silver in gold and gold in silver yields an objective standard that keeps the monetary system honest. For small payments, gold is too valuable, but silver is ideal.