Endnotes

1. U.S. Statutes at Large, Vol. I, p. 246.

2. U.S. Statutes at Large, Vol. X, p. 160, as amended by the Act of February 12, 1873, Statutes at Large, Vol. XVII, p. 424.

3. U.S. Statutes at Large, Vol. V., p. 136.

4. U.S. Statutes at Large, Vol. V., p. 136.

5. U.S. Statutes at Large, Vol. XXXI, p. 45.

6. Public Law 97-258 of September 12, 1982, §5103, codified at Title 31, United States Code, §5103.

7. 12 United States Code §411.

8. Public Law 99-185 of December 17, 1985; U.S. Statutes at Large, Vol. 99, p. 1177, codified at 31 United States Code §5101 & 31 United States Code §5111 & §5112 & §5112(a)(7) – (10).

9. Public Law 99-61 of July 9, 1985; U.S. Statutes at Large, Vol. 99, p. 115; codified at 31 United States Code §5112(e) – (h).

10. Act of February 25, 1863, U.S. Statutes at Large, Vol. XII, p. 345, codified at 31 United States Code §5115.

11. 31 United States Code §5103.

12. 31 United States Code §5112.

13. Coinage Act of April 2, 1792, see Note 1 above.

14. Gold Standard Act of March 14, 1900, see Note 5 above.

15. 31 United States Code §5112, various subsections.

16. See also 31 United States Code §5118(d)(2), “An obligation [payable in United States money] containing a gold clause is discharged on payment (dollar for dollar) in United States coin or currency that is legal tender at the time of payment. This paragraphs does not apply to an obligation issued after October 27, 1977.”

17. Thompson v. Butler, 95 U.S. 69p4, at 696 (1878), emphasis added. See also Bronson v. Rodes, 74 U.S. (7 Wall.) 299 (1869).

18. Since October 27, 1977, per 31 U.S.C. §5118(d). See Note 16 above.

19. James U. Blanchard and Franklin Sanders. Silver Bonanza: How to Profit from the Coming Bull Market. Jefferson, Louisiana: Jefferson Financial, 1993, p. ix.

20. https://home.solari.com/cash-friday/

22. https://ourmoney.solari.com/

23. Or maybe it was only $16 trillion, as the GAO estimated. See https://www.levyinstitute.org/publications/29000000000000-a-detailed-look-at-the-feds-bailout-of-the-financial-system

24. Technically, U.S. Law at Title 31 USC section 5118 says, “(1) ‘gold clause’ means a provision in or related to an obligation alleging to give the obligee a right to require payment in (A) gold; (B) a particular United States coin or currency; or (C) United States money measured in gold or a particular United States coin or currency.”

25. 74 U.S. (7 Wallace) 229 (1869).

26. Ibid, 247-248.

27. Thompson v. Butler, 95 US 694,696 (1877).

28. H.R.J. Res. No. 192, 5 June 1933, ch. 48, § 1(a), 48 Stat. 112, 113.

29. 31 USC Section 5118(d)(2).

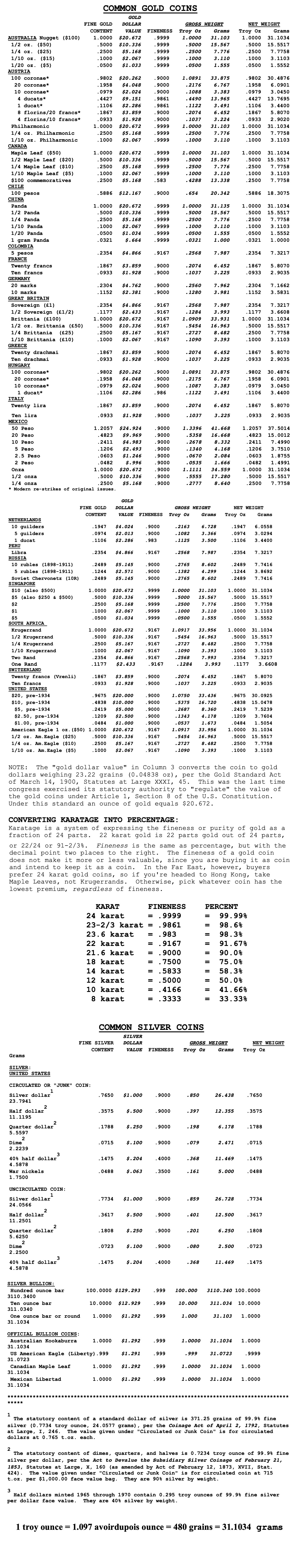

Appendix 1. Common Gold & Silver Coins

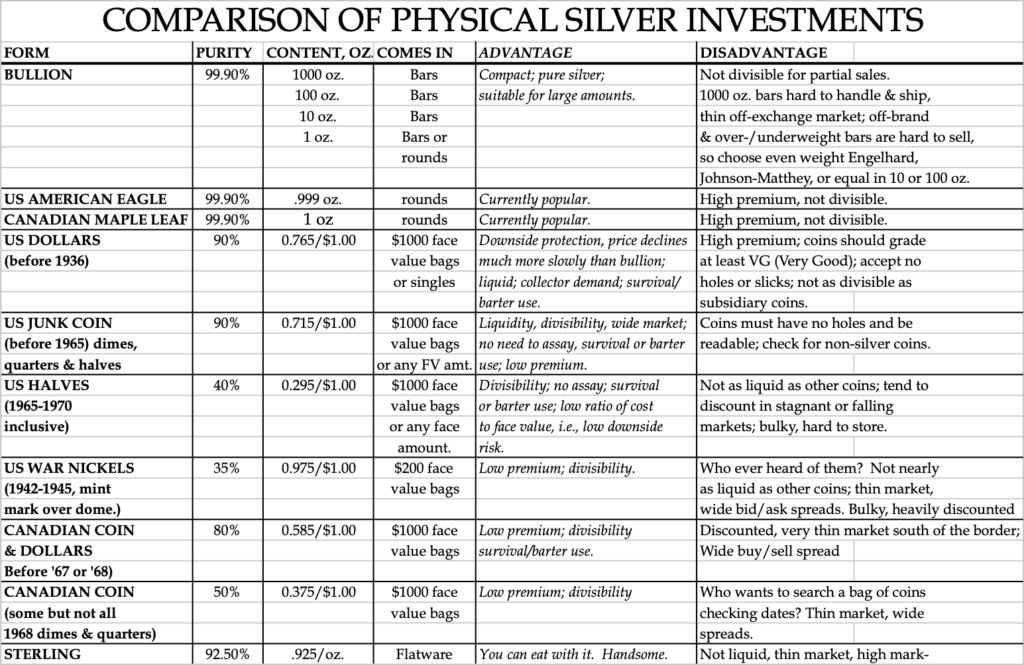

Appendix 2. Comparison of Physical Silver Investments

Appendix 3: Gold Clause Contract Example

PAYMENT CLAUSE & RECEIPT

This Legal Services Payment Clause, “Agreement”, made effective this ___ day of _________, 20__, by and between ________ “Lawyer” and, “Client,” __________.

(a) Authorization and Construction. This Agreement is authorized by, relies upon, and must be construed and implemented according to:

(i) Section 4(c) of the Act of 28 October 1977, Public Law 95-147, 91 Statutes at Large 1227, 1229, now codified in 31 United States Code, Section 5118(d)(2);

(ii) Section 2(a)(7) of the Act of 17 December 1985, Public Law 99-185, 99 Statutes at Large 1177, 1177, now codified in Title 31, United State Code, Section 5112(a)(7);

(iii) Title II, Section 202(h) of the Act of 9 July 1985, Public Law 99-61, 99 Statutes at Large 113, 116, now codified in Title 31, United States Code, Section 5112(h);

(iv) the decisions of the Supreme Court of the United States in New York ex rel. Bunk of New York v. Board of Supervisors, 74 U.S. (7 Wallace) 26 (1869); Bronson v. Rodes, 74 U.S. (7 Wallace) 229 (1869); Butler v. Horowitz, 74 U.S. (7 Wallace) 258 (1869); and Thompson v. Butler, 95 U.S. 694 (1878); and

(v) such other authorities as the Lawyer, the Client, or both may invoke in the event of any challenge, by any third party and for any reason, to the propriety, sufficiency, or effect of any part of this Agreement.

(b) Valuation of Payment. Payment for the legal services shall be valued at Four Hundred ($400.00) “dollars” of coined gold, each such “dollar” to consist of two one-hundredths (0.02) of a Troy ounce of fine gold in the form of the coins hereinafter specified in Section (c) of this Agreement, as authorized pursuant to:

(i) the valuation of “fifty dollar [s]” in gold coin as “contain[ing] one (1) troy ounce of fine gold,” established and implemented by the Congress of the United States in Section 2(a)(7) of the Act of 17 December 1985, Public Law 99-185, 99 Statutes at Large 1177, 1177, now codified in Title 31, United State Code, Section 5112 (a)(7), enacted under Congress’s exclusive power “[t]o coin Money, [and] regulate the Value thereof” in Article I, Section 8, Clause 5 of the Constitution of the United States; and

(ii) the rule set down by the Supreme Court of the United States in Thompson v. Butler, 95 U.S. 694,696 (1878) that:

[o]ne owing a debt may pay it in gold coin or legal-tender notes of the United States, as he chooses, unless there is something to the contrary in the obligation out of which the debt arises. A coin dollar is worth no more for the purposes of tender in payment of an ordinary debt than a note dollar. The law has not made the note a standard of value any more than coin. It is true that in the market, as an article of merchandise, one is of greater value than the other; but as money, that is to say, as a medium of exchange, the law knows no difference between them.

(c) Delivery and Satisfaction of Payment. Payment for the legal services shall consist only, and be executed exclusively through physical delivery by the Client (or his authorized agent) to the Lawyer (or his authorized agent), of eight (8) American Eagle “fifty dollar gold coin[s]” –

(i) each of which “contains one (1) troy ounce of fine gold,” pursuant to Section 2(a)(7) of the Act of 17 December 1985, Public Law 99-185, 99 Statutes at Large 1177, 1177, now codified in Title 31, United States Code, Section 5112(a)(7);

(ii) each of which has been designated “legal tender” by Congress under Title II, Section 202(h) of the Act of 9 July 1985, Public Law 99-61, 99 Statutes at Large 113, 116, now codified in Title 31, United States Code, Sections 5112 (h) and 5103; and

(iii) which collectively shall constitute the sole and exclusive medium of exchange, money, currency, and legal tender for the purposes of this Agreement.

(d) Specific Performance of and Arbitration Regarding Payment; Impossibility of Performance. The Lawyer and Client mutually agree that:

(i) no medium of payment, money, currency, or legal tender other than the fifty dollar ($50.00) American Eagle gold coins heretofore specified in Section (c) of this Agreement may be tendered, accepted, or in any other way used for payment and satisfaction of this CLAUSE in whole or in any part;

(ii) in the event of any breach of this Agreement with respect to payment and satisfaction of this Agreement by the Client, the sole and exclusive remedy and relief which the Lawyer shall seek, and to which the Lawyer shall be entitled and the Client shall be liable, shall be specific performance of this CLAUSE by the Client, in whole or in such part as may prove necessary; and

(iii) in the event of any alleged breach, disagreement as to performance, or other issue related to implementation of this Agreement, the matter shall be subject to binding arbitration, pursuant to the ARBITRATION CLAUSE of this Agreement, the arbitrator to be bound by and required to enforce the terms and conditions of this Agreement, to the exclusion of any other damages, remedy, or relief; but

(iv) in the event that performance and satisfaction of this Agreement as specified herein shall be rendered impossible, because the ownership, possession, or use as a medium of exchange or legal tender of American Eagle gold coins has been declared illegal or otherwise prohibited by competent governmental authority prior to such performance and satisfaction, this Agreement shall be null and void in toto.

(e) Disclaimer. This Agreement is not intended to be, to operate as, or to be construed in any manner as, or for any purpose of, an “abusive tax shelter” or other unlawful means to defeat, evade, or avoid any lawful tax or other public charge, due, or debt arising out of the underlying transaction to which this Agreement pertains. In particular, this Agreement does not necessarily purport, in, of, or by itself alone, to establish that either the aggregate nominal face value of the American Eagle gold coins specified for payment in this Agreement, or the free market value of such coins expressed in any other coin or currency, is or should be the monetary value to be used in the calculation of any tax, or other public charge, due, or debt that might be or become applicable to the underlying transaction to which this Agreement relates. Rather, this Agreement presumes that the value to be assigned to the American Eagle gold coins specified for payment in this Agreement, and the particular coin or currency in which that value is to be expressed, for the purpose of calculating any tax, or other public charge, due, or debt that might be or become applicable to the underlying transaction to which this Agreement relates, will be determined pursuant to those provisions of the Constitution of the United States, and of valid statutes, regulations, or other lawful enactments or requirements, as well as relevant judicial decisions, that apply to any such valuation (including, but not necessarily limited to, the statutes and judicial decisions cited in this Agreement).

(f) Receipt of Full Payment. The Lawyer hereby acknowledges that the Client has tendered and the Lawyer has accepted and received the full payment specified in Section (c) of this Agreement.

Initialed as acknowledgment of receipt of full payment ________________

Lawyer

(g) Multiple Counterparts. If this agreement is signed in multiple counterparts, the aggregate will constitute the entire agreement.

Signed: _________________________ Signed:_____________________________

Client Lawyer