Day by day, America’s monetary and financial system teeters on the edge of a cliff. Since 2008, it is not just the recurring recessions and the boom and bust cycle caused by the banking system that have terrified us, but also what insane new path the Federal Reserve might invent to meet the next crisis.

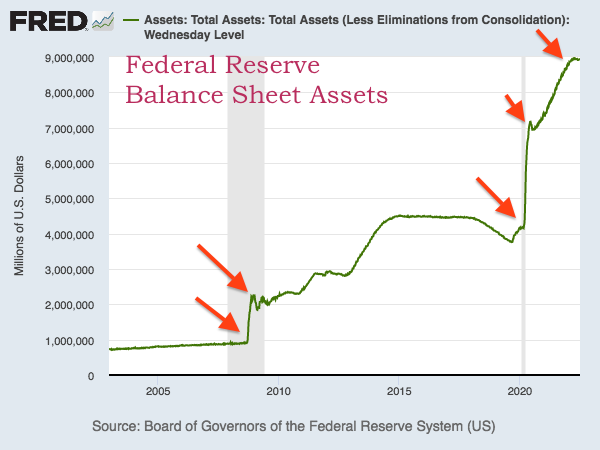

When the Fed buys assets for its balance sheet, it creates money out of thin air to buy those assets, so we watch that balance sheet to see what the Fed is really doing. In 2008, it bailed out the world’s banking system—$700 billion for the favored U.S. banks, courtesy of taxpayers, and another $29 trillion in Federal Reserve loans to banks all over the world.23 In the process, it doubled the assets on its balance sheet in two months.

In 2020, it was helicopter money to rescue citizens paralyzed and impoverished by the federal government’s Covid lockdown. In four months, the Fed boosted its balance sheet assets by 70% and doubled them in about 20 months. Look at the chart, Federal Reserve Balance Sheet Assets, and gasp. We’ve reached a stage where worrying about hyperinflation is no longer ridiculous.

Is there any way we can extricate ourselves from this lunacy? Yes, we can use “gold clauses” in our business and financial transactions.

What Is a Gold Clause?

A “gold clause” is simply a provision in a contract that requires payment in gold or silver.24 (Appendix 3 contains a sample gold clause contract.) When your contract specifies payment in this form, you make an end run around legal tender laws that force you to accept payment in Federal Reserve bank credit money. How? By specifying payment—specific performance—in silver or gold. You can stipulate U.S. legal tender gold or silver coins or some combination of both, or require payment in gold or silver bullion.

Who may use a gold clause? Every common American and every state, but not the federal government.

From the late 1700s until 1933, all United States securities were tied to gold and silver coin as the monetary system’s foundation. They were, so to speak, all gold clause contracts. However, during the War Between the States, the U.S. government issued unbacked legal tender Greenback paper currency. Its speedy depreciation—at its July 1864 low it traded at a 65% discount to gold—led Americans to avoid Greenbacks with gold clauses.

The legality of these gold clauses against the legal tender laws wound its way to the Supreme Court in 1869 in Bronson v. Rodes.25 The court concluded that:

[a] contract to pay a certain number of dollars in gold or silver coins is, therefore, in legal import, nothing else than an agreement to deliver a certain weight of standard gold, to be ascertained by a count of coins, each of which is certified to contain a definite proportion of that weight. It is not distinguishable * * * , in principle, from a contract to deliver an equal weight of bullion of equal fineness. It is distinguishable, in circumstance, only by the fact that the sufficiency of the amount to be tendered in payment must be ascertained, in the case of bullion, by assay and the scales, while in the case of coins it may be ascertained by count.26

The court then also denied that “a contract to pay coined money may be satisfied by a tender of United States notes [Greenbacks].”

The court added to this in 1877 in Thompson v. Butler:

A coin dollar is worth no more for the purpose of tender in payment of an ordinary debt than a note dollar. The law has not made the note a standard of value any more than coin. It is true that in the market, as an article of merchandise, one is of greater value than the other; but as money, that is to say, as a medium of exchange, the law knows no difference between them.27

Despite the hallowed antiquity of gold clauses, in 1933, the panic of banking crisis and depression moved Congress in House Joint Resolution No. 192 to outlaw most gold clauses.28 However, in 1977, Congress legislated that the Joint Resolution shall not apply to “obligations issued on or after [28 October 1977],” thereby restoring every American’s right to make gold clauses.29

Today, U.S. monetary conditions are essentially in the same muddle they suffered under immediately after the War Between the States:

- Laws for coining gold and silver have never been repealed, and the U.S. mint is still striking gold and silver coins.

- Those gold and silver coins are still legal tender.

- There are two types of “money”: gold and silver American Eagle coins and paper currency consisting of Federal Reserve notes.

- All these kinds of money are denominated in dollars, but the Federal Reserve note dollar is not officially convertible into a gold or silver dollar.

- These different dollars are not actual equivalents.

- So, the law sanctions contracts to be paid in any kind of dollars.

Thus, common citizens and states are free to employ whatever kind of dollars they desire, except that the Constitution at Article I, Section 10 says that “no State shall. . . make any Thing but gold and silver Coin a Tender in Payment of Debts.” That is a power reserved to the states, so a state could actually adopt gold and silver as its currency in preference to Federal Reserve currency—but don’t look for that to happen soon without a monstrous crisis.

What Gold Clauses Can Do for You

If you state in all your contracts that the only legal tender for your business is gold, silver, or gold and silver, you can effectively demonetize Federal Reserve notes and separate your finances from the Federal Reserve system entirely. You can put your own household on a sound, stable monetary foundation and escape the unstable Federal Reserve and fractional reserve banking scheme, not to mention any potential hyperinflation.

Of course, it would help if your state abolishes laws like sales taxes and capital gains taxes that cripple the circulation of silver and gold, and enacts positive statutes like those Utah and Oklahoma have enacted recognizing gold and silver as legal tender.

The Complication

To most readers, it will be immediately obvious that a large potential tax question exists. The Internal Revenue Service (IRS) wants to insist that when you receive legal-tender gold or silver coins, you must value them in Federal Reserve note dollars and pay capital gains when you sell them, although there is no law to this effect, only the IRS’s interpretation. One wonders what they would do if your revenue was paid to you only in gold and silver dollars, and you paid your income tax in the same gold or silver dollars.

We sternly warn you not to play both sides of the street, taking revenue in gold and silver dollars, claiming the nominal dollar amount to lower your nominal income, then paying your tax in Federal Reserve notes.

Regardless what we believe the law allows, we know of several cases where folks tried this, were tried by the IRS, couldn’t explain their whole argument to a jury (most lawyers cannot or would be afraid to try), and wound up in prison. That sort of fight will consume your wealth and your life, and simply isn’t worth it.

We sternly and earnestly repeat: do not use gold and silver clauses for such a scheme. By all means, use them to protect your property and to escape the fiat money system, but not to avoid or evade income taxes.

A coin dollar is worth no more for the purpose of tender in payment of an ordinary debt than a note dollar.

~ Thompson v. Butler, 95 US 694,696 (1877)

Continue to Endnotes and Appendices